2.1. Swift wire transfer¶

2.1.1. Swift transfer API¶

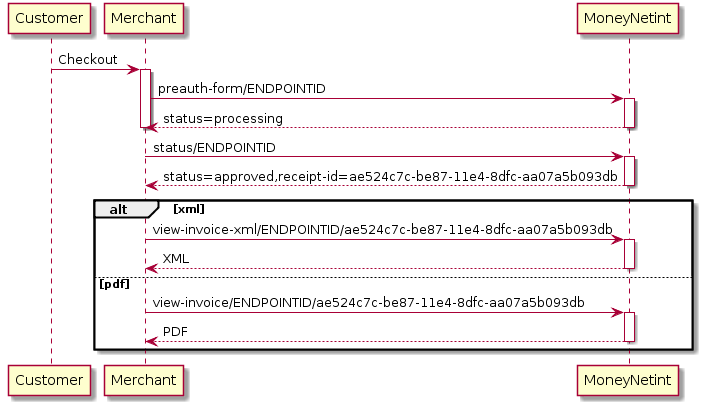

To start Swift transaction use Payment form to get receipt-id in order status. https://pne-gate.moneynetint.com/paynet/api/v2/preauth-form/ENDPOINTID

For integration purposes use staging environment pne-sandbox.moneynetint.com instead of production pne-gate.moneynetint.com

Payment Form Request Parameters¶

| Request parameter name | Length/Type | Comment | Necessity* |

|---|---|---|---|

| client_orderid | 128/String | Merchant order identifier. | Mandatory |

| order_desc | 64k/String | Brief order description | Mandatory |

| first_name | 50/String | Customer’s first name | Optional |

| last_name | 50/String | Customer’s last name | Optional |

| ssn | 32/Numeric | Last four digits of the customer’s social security number. | Optional |

| birthday | 8/Numeric | Customer’s date of birth, in the format YYYYMMDD. | Optional |

| address1 | 50/String | Customer’s address line 1. | Mandatory |

| city | 50/String | Customer’s city. | Mandatory |

| state | 2/String | Customer’s state (two-letter state code). Please see Reference for a list of valid state codes. Mandatory for USA, Canada and Australia. | Conditional |

| zip_code | 10/String | Customer’s ZIP code | Mandatory |

| country | 2/String | Customer’s country(two-letter country code). Please see Reference for a list of valid country codes. | Mandatory |

| phone | 15/String | Customer’s full international phone number, including country code. | Optional |

| cell_phone | 15/String | Customer’s full international cell phone number, including country code. | Optional |

| 50/String | Customer’s email address. | Mandatory | |

| amount | 10/Numeric | Amount to be charged. The amount has to be specified in the highest units with . delimiter. 10.5 for USD means 10 US Dollars and 50 Cents | Mandatory |

| currency | 3/String | Currency the transaction is charged in (three-letter currency code). Sample values are: USD for US Dollar EUR for European Euro | Mandatory |

| ipaddress | 20/String | Customer’s IP address, included for fraud screening purposes. | Mandatory |

| site_url | 128/String | URL the original sale is made from. | Optional |

| control | 40/String | Checksum generated by SHA-1. See Request authorization through control parameter for more details. | Mandatory |

| redirect_url | 128/String | URL the cardholder will be redirected to upon completion of the transaction. Please note that the cardholder will be redirected in any case, no matter whether the transaction is approved or declined. You should not use this parameter to retrieve results from MoneyNetint gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. | Mandatory |

| server_callback_url | 128/String | URL the transaction result will be sent to. Merchant may use this URL for custom processing of the transaction completion, e.g. to collect sales data in Merchant’s database. See more details at Merchant Callbacks | Optional |

Payment Form Response¶

| Response parameter name | Description |

|---|---|

| type | The type of response. May be async-form-response, validation-error, error. If type equals validation-error or error, error-message and error-code parameters contain error details. |

| status | Status List for details. |

| paynet-order-id | Order id assigned to the order by MoneyNetint |

| merchant-order-id | Merchant order id |

| serial-number | Unique number assigned by MoneyNetint server to particular request from the Merchant. |

| error-message | If status is declined or error this parameter contains the reason for decline or error details |

| error-code | The error code is case of declined or error status |

| redirect_url | The URL to the page where the Merchant should redirect the client’s browser. Merchant should send HTTP 302 redirect, see General Payment Form Process Flow |

Swift invoice URL¶

To get Swift notification in XML use URL https://pne-gate.moneynetint.com/paynet/view-invoice-xml/ENDPOINTID/RECEIPTID

To get Swift notification in PDF use URL https://pne-gate.moneynetint.com/paynet/view-invoice/ENDPOINTID/RECEIPTID

Request authorization and debug¶

OAuth realm="",

oauth_version="1.0",

oauth_signature_method="HMAC-SHA1",

oauth_consumer_key="merchantlogin",

oauth_timestamp="1513785920",

oauth_nonce="EqINVv5rkhx",

oauth_signature="9bSeUoR5yJSSJ4KPhotT%2BofEHSQ%3D"

To reproduce your API call, input all of the data from your original request, including the authentication tokens. Don’t forget to set the nonce and timestamp to the values you used. An OAuth signed URL should match regardless of the generating library. If the signatures differ, you know there is a bug in your OAuth signature code.

| normalized parameters |

|---|

| signature base string |

|---|

| signature |

|---|

| authorization header |

|---|

| Curl |

|---|

|

2.1.2. Extended Swift wire transfer flow¶

Swift wire transfers handling may be done manually on user interface, using batch upload or via API integration. The following transaction statuses may be available for better control of Swift transfer transactions (please ask your support manager for details):

| Stage name | Description |

|---|---|

| AUTH_STARTING | Transaction was initiated |

| AUTH_INVOICED | Invoice was issued for the customer. It may be downloaded in back-office, sent to customer by e-mail or requested via API. |

| AUTH_SENT | Customer informed the merchant that invoice have been paid. This stage may be skipped. |

| CANCEL_APPROVED | Customer didn’t complete the transfer. This stage is optional and may be used for better transaction control in back-office. |

| AUTH_APPROVED | Transfer was received by the bank. |

| CAPTURE_APPROVED | Funds were transferred to the merchant’s account (settled). |

| VOID_APPROVED | Funds were returned by the customer (recalled). |

| REVERSAL_APPROVED | Funds were returned to the customer by merchant. |

| CHARGEBACK_APPROVED | Funds were charged back by the customer. |