1.1.2. Preauth/Capture Trаnsactions¶

- Direct Integration

- Payment Form Integration

Direct Integration¶

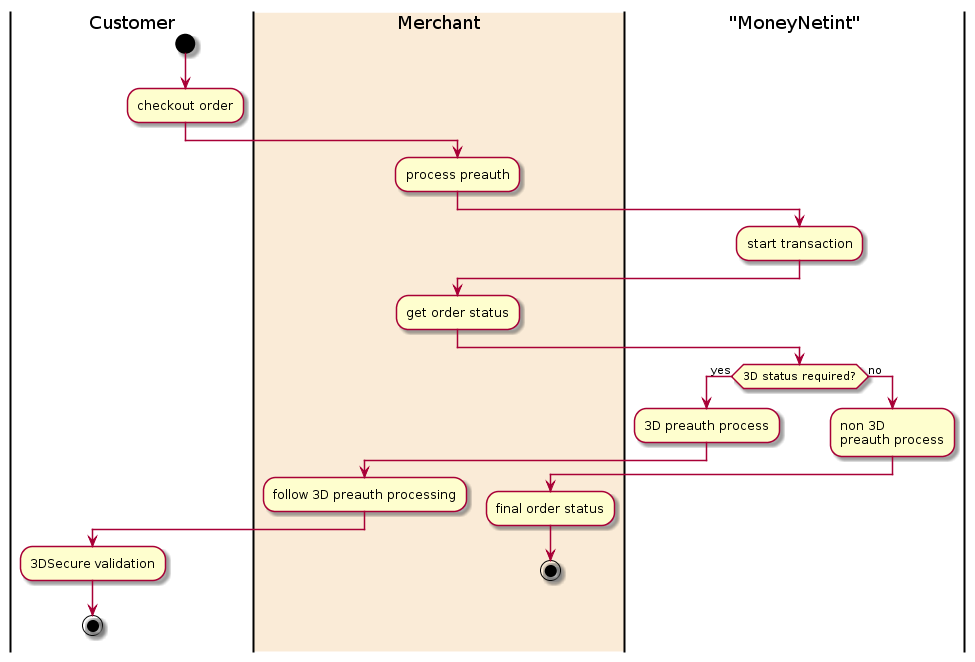

Preauth Transaction General Flow¶

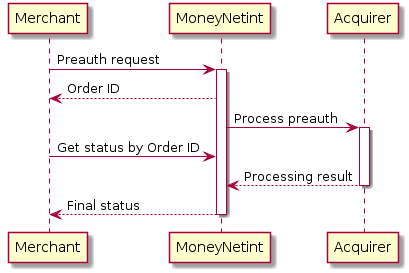

Non 3D Preauth transaction diagram¶

Merchant is using single entry point for both 3D and Non 3D Preauth transactions. Actually the Merchant can not know beforehand if the Preauth will be driven through 3D authorization scheme. The Merchant should use MoneyNetint API as described in General Preauth Process Flow.

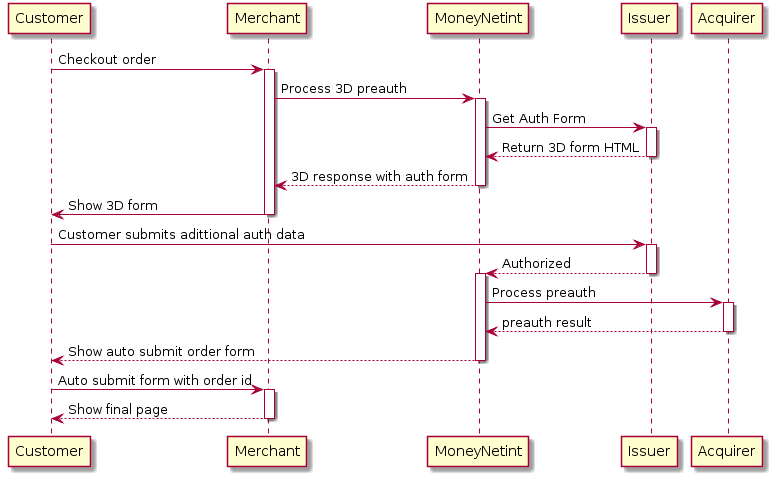

3D Preauth transaction diagram¶

Merchant is using single entry point for both 3D and Non 3D Preauth transactions. Actually the Merchant can not know beforehand if the Preauth will be driven through 3D authorization scheme. The Merchant should use MoneyNetint API as described in General Preauth Process Flow.

Process Preauth transaction¶

For integration purposes use staging environment pne-sandbox.moneynetint.com instead of production pne-gate.moneynetint.com. Preauth transactions are initiated through HTTPS POST request by using URL in the following format:

Preauth transaction by ENDPOINTID¶

The End point ID is an entry point for incoming Merchant’s transactions for single currency integration.

https://pne-gate.moneynetint.com/paynet/api/v2/preauth/ENDPOINTID – for pre-auth transaction

Preauth transaction by ENDPOINTGROUPID¶

The End point group ID is an entry point for incoming Merchant’s transactions for multi currency integration.

https://pne-gate.moneynetint.com/paynet/api/v2/preauth/group/ENDPOINTGROUPID – for pre-auth transaction

Preauth Request Parameters¶

In order to initiate a Preauth transaction Merchant sends an HTTPS POST request with the parameters specified in Preauth Request Parameters Table below

| Preauth Request Parameter | Length/Type | Comment | Necessity* |

|---|---|---|---|

| client_orderid | 128/String | Merchant order identifier. | Mandatory |

| order_desc | 125/String | Brief order description | Mandatory |

| card_printed_name | 64k/String | Card printed name | Mandatory |

| first_name | 50/String | Customer’s first name | Mandatory |

| last_name | 50/String | Customer’s last name | Mandatory |

| ssn | 32/Numeric | Last four digits of the customer’s social security number. | Optional |

| birthday | 8/Numeric | Customer’s date of birth, in the format YYYYMMDD. | Optional |

| address1 | 50/String | Customer’s address line 1. | Mandatory |

| city | 50/String | Customer’s city. | Mandatory |

| state | 2-3/String | Customer’s state . Please see Reference for a list of valid state codes. Mandatory for USA, Canada and Australia. | Conditional |

| zip_code | 10/String | Customer’s ZIP code | Mandatory |

| country | 2/String | Customer’s country(two-letter country code). Please see Reference for a list of valid country codes. | Mandatory |

| phone | 15/String | Customer’s full international phone number, including country code. | Mandatory |

| cell_phone | 15/String | Customer’s full international cell phone number, including country code. | Optional |

| 50/String | Customer’s email address. | Mandatory | |

| amount | 10/Numeric | Amount to be charged. The amount has to be specified in the highest units with . delimiter. For instance, 10.5 for USD means 10 US Dollars and 50 Cents | Mandatory |

| currency | 3/String | Currency the transaction is charged in (three-letter currency code). Sample values are: USD for US Dollar EUR for European Euro | Mandatory |

| credit_card_number | 20/Numeric | Customer’s credit card number. | Mandatory |

| expire_month | 2/Numeric | Credit card expiration month | Mandatory |

| expire_year | 4/Numeric | Credit card expiration year | Mandatory |

| cvv2 | 3-4/Numeric | Customer’s CVV2 code. CVV2 (Card Verification Value) is a three- or four-digit number AFTER the credit card number in the signature area of the card. | Mandatory |

| ipaddress | 20/String | Customer’s IP address, included for fraud screening purposes. | Mandatory |

| site_url | 128/String | URL the original Preauth is made from. | Optional |

| purpose | 128/String | Destination to where the payment goes. It is useful for the merchants who let their clients to transfer money from a credit card to some type of client’s account, e.g. game or mobile phone account. Sample values are: +7123456789; gamer0001@ereality.com etc. This value will be used by fraud monitoring system. | Optional |

| control | 40/String | Checksum generated by SHA-1. See Request authorization through control parameter for more details. | Mandatory |

| redirect_url | 1024/String | URL the cardholder will be redirected to upon completion of the transaction. Please note that the cardholder will be redirected in any case, no matter whether the transaction is approved or declined. You should not use this parameter to retrieve results from MoneyNetint gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. Pass http://google.com if you use non3D schema for transactions processing and you have no need to return customer anywhere. | Mandatory |

| server_callback_url | 1024/String | URL the transaction result will be sent to. Merchant may use this URL for custom processing of the transaction completion, e.g. to collect Preauth data in Merchant’s database. See more details at Merchant Callbacks | Optional |

| merchant_data | 64k/String | Any additional information for this transaction which may be useful in Merchant’s external systems, e.g. VIP customer, TV promo campaign lead. Will be returned in Status response and Merchant Callback. | Optional |

Please note the following characters must be escaped in the parameter values: & + “.

Preauth Request Example¶

client_orderid=123098

credit_card_number=XXXX XXXX XXXX XXXX

expire_year=2012

expire_month=8

cvv2=XXX

amount=114.94

control=b78f3420dasdef50469a6fd40c7625cd5a1f05eba

card_printed_name=Francis Benedict

ipaddress=115.135.52.242

state=

currency=USD

phone=+6072344354

zip_code=81200

order_desc=Super product 1

email=francislusaikun@yahoo.com

country=MY

city=Johor Bahru

address1=11Jalan Lurah 6 Kg. Kempas Baru

&merchant_data=VIP customer

Preauth Response¶

| Preauth Response Parameter | Description |

|---|---|

| type | The type of response. May be async-response, validation-error, error. If type equals validation-error or error, error-message and error-code parameters contain error details. |

| paynet-order-id | Order id assigned to the order by MoneyNetint |

| merchant-order-id | Merchant order id |

| serial-number | Unique number assigned by MoneyNetint server to particular request from the Merchant. |

| error-message | If status is error this parameter contains the reason for decline or error details |

| error-code | The error code is case of error status |

| end-point-id | Endpoint id used for the transaction |

Preauth Response Example¶

type=async-response

&serial-number=00000000-0000-0000-0000-000002d53397

&merchant-order-id=902B4FF5

&paynet-order-id=6666821

&end-point-id=2489

3D redirect¶

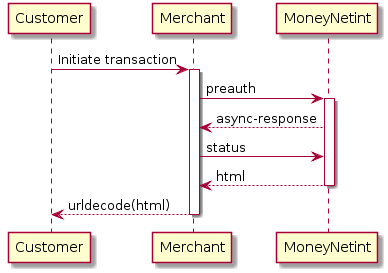

If your gate supports 3D Secure you need to send status request and process html return parameter to send customer to 3D Secure Authorisation. The simplified schema looks like:

html field is always present for 3D gates in status response, whether clients card supports 3D Secure or not.

Upon completion of 3D authorization process by the Customer he/she is automatically redirected to redirect_url. The redirection is performed as an HTTPS POST request with the parameters specified in the following table.

| 3D redirect Parameter | Description |

|---|---|

| status | See Status List for details. |

| orderid | Order id assigned to the order by MoneyNetint |

| merchant_order | Merchant order id |

| client_orderid | Merchant order id |

| error_message | If status is declined or error this parameter contains the reason for decline or error details |

| control | Checksum used to ensure that it is MoneyNetint (and not a fraudster) that initiates the request. This is SHA-1 checksum of the concatenation status + orderid + client_orderid + merchant-control. |

| descriptor | Gate descriptor |

If Merchant has passed server_callback_url in original Preauth request MoneyNetint will call this URL. Merchant may use it for custom processing of the transaction completion, e.g. to collect sales data in Merchant’s database. The parameters sent to this URL are specified in Sale, Return Callback Parameters

Server callback result¶

Upon completion by the System of 3D request processing it returns the result on the specified server_callback_url with the following parameters described in Sale, Return Callback Parameters

The checksum is used to ensure that the callback is initiated for a particular Merchant, and not for anybody else claiming to be such Merchant. This SHA-1 checksum, the control parameter, is created by concatenation of the parameters values in the following order:

- status

- orderid

- client_orderid

- merchant_control

A complete string example may look as follows:

approvedS279G323P4T1209294c258d6536ababe653E8E45B5-7682-42D8-6ECC-FB794F6B11B1

Encrypt the string using SHA-1 algorithm. The resultant string yields the control parameter. For the above-mentioned example the control will take the following value:

e04bd50531f45f9fc76917ac78a82f3efaf0049c

All parameters are sent via POST method.

Server callback result example¶

status=declined

&error-message=Decline, refer to card issuer

&error-code=107

&paynet-order-id=S279G323P4T1209294

&merchant-order-id=c258d6536ababe65

Process Capture Transaction¶

The Capture operation initiates after successful complete of the Preauth operation to deduct blocked amount from the customer’s card.

For integration purposes use staging environment pne-sandbox.moneynetint.com instead of production pne-gate.moneynetint.com. Capture transactions are initiated through HTTPS POST request by using URL in the following format:

Capture Transaction by ENDPOINTID¶

The End point ID is an entry point for incoming Merchant’s transactions for single currency integration.

https://pne-gate.moneynetint.com/paynet/api/v2/capture/ENDPOINTID – for capture transaction

Capture Transaction by ENDPOINTGROUPID¶

The End point group ID is an entry point for incoming Merchant’s transactions for multi currency integration.

https://pne-gate.moneynetint.com/paynet/api/v2/capture/group/ENDPOINTGROUPID – for capture transaction

Capture Request¶

| Capture Request Parameter | Description |

|---|---|

| login | Merchant login name |

| client_orderid | Merchant order identifier of the transaction for which the status is requested |

| orderid | Order id assigned to the order by MoneyNetint |

| control | Checksum used to ensure that it is MoneyNetint (and not a fraudster) that initiates the callback for a particular Merchant. This is SHA-1 checksum of the concatenation login + merchant-order-id + paynet-order-id + amount_in_cents(if sent) + currency(if amount sent) + merchant-control. |

Capture Response¶

| Capture Response Parameter | Description |

|---|---|

| type | The type of response. May be async-response, validation-error, error. If type equals validation-error or error, error-message and error-code parameters contain error details. |

| paynet-order-id | Order id assigned to the order by MoneyNetint |

| merchant-order-id | Merchant order id |

| serial-number | Unique number assigned by MoneyNetint server to particular request from the Merchant. |

| error-message | If status is error this parameter contains the reason for decline or error details |

| error-code | The error code is case of error status |

| end-point-id | Endpoint id used for the transaction |

Capture Response Example¶

type=async-response

&serial-number=00000000-0000-0000-0000-000002d53397

&merchant-order-id=902B4FF5

&paynet-order-id=6666821

&end-point-id=2489

Preauth and Capture request authorization through control parameter¶

The checksum is used to ensure that it is a particular Merchant (and not a fraudster) that initiates the transaction. This SHA-1 checksum, the parameter control, is created by concatenation of the parameters values in the following order:

- ENDPOINTID/ENDPOINTGROUPID

- client_orderid

- minimal monetary units amount (i.e. cent, penny etc.)

- merchant_control

A complete string example may look as follows:

59I6email@client.com3E8E45B5-2-42D8-6ECC-FBF6B11B1

Encrypt the string using SHA-1 algorithm. The resultant string yields the control parameter (see Sale Request Parameters) which is required for request authorization. For the above-mentioned example the control will take the following value:

5b1da0a20a1b9ff4d66caaba15a3e7ee13

Order status¶

Merchant must use Order status API call to get the customer’s order transaction status. After any type of transaction is sent to MoneyNetint server and order id is returned, Merchant should poll for transaction status. When transaction is processed on MoneyNetint server side it returns it’s status back to Merchant and at this moment the Merchant is ready to show the customer transaction result, whether it’s approved or declined.

Status API URL¶

For integration purposes use staging environment pne-sandbox.moneynetint.com instead of production pne-gate.moneynetint.com. Status API calls are initiated through HTTPS POST request by using URL in the following format:

Order status call parameters¶

| Status Call Parameter | Description |

|---|---|

| login | Merchant login name |

| client_orderid | Merchant order identifier of the transaction for which the status is requested |

| orderid | Order id assigned to the order by MoneyNetint |

| control | Checksum used to ensure that it is MoneyNetint (and not a fraudster) that initiates the callback for a particular Merchant. This is SHA-1 checksum of the concatenation login + client-order-id + paynet-order-id + merchant-control. See Order status API call authorization through control parameter for more details about generating control checksum. |

| by-request-sn | Serial number assigned to the specific request by MoneyNetint. If this field exist in status request, status response return for this specific request. |

Order Status Response¶

| Status Response Paramete | Description |

|---|---|

| type | The type of response. May be status-response |

| status | See Status List for details. |

| amount | Actual transaction amount. This value can be changed during the transaction flow. |

| currency | Currency of the initial transaction. |

| paynet-order-id | Order id assigned to the order by MoneyNetint |

| merchant-order-id | Merchant order id |

| phone | Customer phone. |

| html | HTML code of 3D authorization form, encoded in application/x-www-form-urlencoded MIME format. Merchant must decode this parameter before showing the form to the Customer. The MoneyNetint System returns the following response parameters when it gets 3D authorization form from the Issuer Bank. It contains auth form HTML code which must be passed through without any changes to the client’s browser. This parameter exists and has value only when the redirection HTML is already available. For non-3D this never happens. For 3D HTML has value after some short time after the processing has been started. |

| redirect-to | For 3Ds authorization the merchant can redirect the customer to URL provided in this parameter instead of rendering the page provided in html parameter. The redirect-to parameter is returned only if the html parameter is returned. Merchant should send HTTP 302 redirect. This parameter must be used to work with 3DS 2.0. |

| serial-number | Unique number assigned by MoneyNetint server to particular request from the Merchant. |

| last-four-digits | Last four digits of customer credit card number. |

| bin | Bank BIN of customer credit card number. |

| card-type | Type of customer credit card (VISA, MASTERCARD, etc). |

| gate-partial-reversal | Processing gate support partial reversal (enabled or disabled). |

| gate-partial-capture | Processing gate support partial capture (enabled or disabled). |

| transaction-type | Transaction type (sale, reversal, capture, preauth). |

| processor-rrn | Bank Receiver Registration Number. |

| processor-tx-id | Acquirer transaction identifier. |

| receipt-id | Electronical link to receipt https://pne-gate.moneynetint.com/paynet/view-receipt/ENDPOINTID/receipt-id/ |

| cardholder-name | Cardholder name. |

| card-exp-month | Card expiration month. |

| card-exp-year | Card expiration year. |

| card-hash-id | Unique card identifier to use for loyalty programs or fraud checks. |

| Customer e-mail. | |

| purpose | Destination to where the payment goes. It is useful for the merchants who let their clients to transfer money from a credit card to some type of client’s account, e.g. game or mobile phone account. Sample values are: +7123456789; gamer0001@ereality.com etc. This value will be used by fraud monitoring system. |

| bank-name | Bank name by customer card BIN. |

| terminal-id | Acquirer terminal identifier to show in receipt. |

| paynet-processing-date | Acquirer transaction processing date. |

| approval-code | Bank approval code. |

| order-stage | The current stage of the transaction processing. See Order Stage for details |

| loyalty-balance | The current bonuses balance of the loyalty program for current operation. if available |

| loyalty-message | The message from the loyalty program. if available |

| loyalty-bonus | The bonus value of the loyalty program for current operation. if available |

| loyalty-program | The name of the loyalty program for current operation. if available |

| descriptor | Bank identifier of the payment recipient. |

| error-message | If status in declined, error, filtered this parameter contains the reason for decline |

| error-code | The error code is case status in declined, error, filtered. |

| by-request-sn | Serial number assigned to the specific request by MoneyNetint. If this field exist in status request, status response return for this specific request. |

| verified-3d-status | See 3d Secure Status List for details |

| verified-rsc-status | See Random Sum Check Status List for details |

| merchantdata | If provided in initial request, merchant_data parameter and its value will be included in status response. |

| initial-amount | Amount, set in initiating transaction, without any fees or commissions. This value can’t change during the transaction flow. |

Order Status Response Example¶

type=status-response

&serial-number=00000000-0000-0000-0000-0000005b5eec

&merchant-order-id=6132tc

&processor-tx-id=9568-47ed-912d-3a1067ae1d22

&paynet-order-id=161944

&status=approved

&amount=7.56

&descriptor=no

&gate-partial-reversal=enabled

&gate-partial-capture=enabled

&transaction-type=cancel

&receipt-id=2050-3c93-a061-8a19b6c0068f

&name=FirstName

&cardholder-name=FirstName

&card-exp-month=3

&card-exp-year=2028

&email=no

&processor-rrn=510458047886

&approval-code=380424

&order-stage=cancel_approved

&last-four-digits=1111

&bin=444455

&card-type=VISA

&phone=%2B79685787194

&bank-name=UNKNOWN

&paynet-processing-date=2015-04-14+10%3A23%3A34+MSK

&by-request-sn=00000000-0000-0000-0000-0000005b5ece

&card-hash-id=1569311

&merchantdata=promo

Status request authorization through control parameter¶

The checksum is used to ensure that it is Merchant (and not a fraudster) that sends the request to MoneyNetint. This SHA-1 checksum, the parameter control, is created by concatenating of the values of the parameters in the following order:

- login

- client_orderid

- orderid

- merchant_control

For example assume the following values are corresponds the parameters above:

| Parameter Name | Parameter Value |

|---|---|

| login | cool_merchant |

| client_orderid | 5624444333322221111110 |

| orderid | 9625 |

| merchant_control | r45a019070772d1c4c2b503bbdc0fa22 |

The complete string example may look as follows:

cool_merchant56244443333222211111109625r45a019070772d1c4c2b503bbdc0fa22

Encrypt the string using SHA-1 algorithm. The resultant string yields the control parameter which is required for authorizing the callback. For the example control above will take the following value:

c52cfb609f20a3677eb280cc4709278ea8f7024c

Payment Form Integration¶

Payment Form integration is relevant for merchants who are not able to accept customer card details (merchant’s website must complete PCI DSS certification). In case of Payment Form integration merchant is released of accepting payment details and all this stuff is completely implemented on the MoneyNetint gateway side. In addition merchant may customize the look and feel of the Payment Form. Merchant must send the template to his/her Manager for approval before it could be used.

Payment Form API URL¶

For integration purposes use staging environment pne-sandbox.moneynetint.com instead of production pne-gate.moneynetint.com. Payment Form transactions are initiated through HTTPS POST request by using URL in the following format:

Form Transaction by ENDPOINTID¶

The End point ID is an entry point for incoming Merchant’s transactions for single currency integration.

Form Transaction by ENDPOINTGROUPID¶

The End point group ID is an entry point for incoming Merchant’s transactions for multi currency integration.

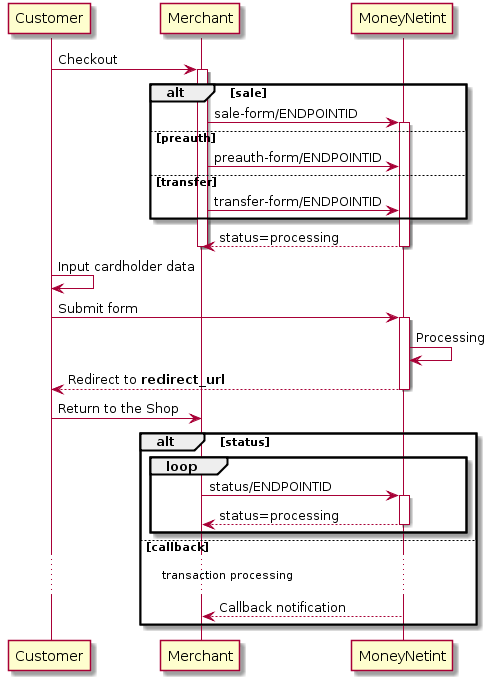

General Payment Form Process Flow¶

Payment form fields¶

This form contains the following fields:

| Form field name | Description |

|---|---|

| credit_card_number | Customer’s credit card number 4455555555555544 |

| expire_month | Credit card expiration month 01 or 12 |

| expire_year | Credit card expiration year 2016 |

| cvv2 | Card security code 432 |

Initiating a transaction with Payment Form¶

Merchant must supply the following parameters to initiate a sale transaction using payment form template.

Payment Form Request Parameters¶

| Request parameter name | Length/Type | Comment | Necessity* |

|---|---|---|---|

| client_orderid | 128/String | Merchant order identifier. | Mandatory |

| order_desc | 64k/String | Brief order description | Mandatory |

| first_name | 50/String | Customer’s first name | Mandatory |

| last_name | 50/String | Customer’s last name | Mandatory |

| ssn | 4/Numeric | Last four digits of the customer’s social security number. | Optional |

| birthday | 8/Numeric | Customer’s date of birth, in the format YYYYMMDD. | Optional |

| address1 | 50/String | Customer’s address line 1. | Mandatory |

| city | 50/String | Customer’s city. | Mandatory |

| state | 2/String | Customer’s state (two-letter state code). Please see Two-Letter Country Codes for a list of valid state codes. Mandatory for USA, Canada and Australia | Conditional |

| zip_code | 10/String | Customer’s ZIP code | Mandatory |

| country | 2/String | Customer’s country(two-letter country code). Please see Two-Letter Country Codes for a list of valid country codes. | Mandatory |

| phone | 15/String | Customer’s full international phone number, including country code. | Mandatory |

| cell_phone | 15/String | Customer’s full international cell phone number, including country code. | Optional |

| 50/String | Customer’s email address. | Mandatory | |

| amount | 10/Numeric | Amount to be charged. The amount has to be specified in the highest units with . delimiter. 10.5 for USD means 10 US Dollars and 50 Cents | Mandatory |

| currency | 3/String | Currency the transaction is charged in (three-letter currency code). Sample values are: USD for US Dollar EUR for European Euro | Mandatory |

| ipaddress | 20/String | Customer’s IP address, included for fraud screening purposes. | Mandatory |

| site_url | 128/String | URL the original sale is made from. | Optional |

| control | 40/String | Checksum generated by SHA-1. See Request authorization through control parameter for more details. | Mandatory |

| redirect_url | 1024/String | URL the cardholder will be redirected to upon completion of the transaction. Please note that the cardholder will be redirected in any case, no matter whether the transaction is approved or declined. You should not use this parameter to retrieve results from MoneyNetint gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. | Mandatory |

| server_callback_url | 1024/String | URL the transaction result will be sent to. Merchant may use this URL for custom processing of the transaction completion, e.g. to collect sales data in Merchant’s database. See more details at Merchant Callbacks | Optional |

| preferred_language | 2/String | Customer’s two-letter language code for multi-language payment forms | Optional |

| merchant_form_data | 128/String | Parameters sent in merchant_form_data API parameter are parsed into macros with the same name, the parameter is url-encoded, example: testparam%3Dtest1%26mynewparam%3Dtest2 and is parsed into $MFD_testparam = test1 and $MFD_mynewparam = test2 macros in the form. Parameter name characters[a-zA-Z0-9], parameter value characters[a-zA-Z0-9], control characters [=&], 2MB max size | Optional |

Payment Form Response¶

| Response parameter name | Description |

|---|---|

| type | The type of response. May be async-form-response, validation-error, error. If type equals validation-error or error, error-message and error-code parameters contain error details. |

| paynet-order-id | Order id assigned to the order by MoneyNetint |

| merchant-order-id | Merchant order id |

| serial-number | Unique number assigned by MoneyNetint server to particular request from the Merchant. |

| error-message | If status is declined or error this parameter contains the reason for decline or error details |

| error-code | The error code in case of declined or error status |

| redirect-url | The URL to the page where the Merchant should redirect the client’s browser. Merchant should send HTTP 302 redirect, see General Payment Form Process Flow |

Payment Form final redirect¶

Upon completion of Payment Form process by the Customer he/she is automatically redirected to redirect_url. The redirection is performed as an HTTPS POST request with the parameters specified in the following table.

| Redirect parameter name | Description |

|---|---|

| status | See Status List for details. |

| orderid | Order id assigned to the order by MoneyNetint |

| merchant_order | Merchant order id |

| client_orderid | Merchant order id |

| error_message | If status is declined or error this parameter contains the reason for decline or error details |

| control | Checksum used to ensure that it is MoneyNetint (and not a fraudster) that initiates the request. This is SHA-1 checksum of the concatenation status + orderid + client_orderid + merchant-control. |

| descriptor | Gate descriptor |

If Merchant has passed server_callback_url in original Payment Form request MoneyNetint will call this URL. Merchant may use it for custom processing of the transaction completion, e.g. to collect sales data in Merchant’s database. The parameters sent to this URL are specified in Sale, Return Callback Parameters

Payment Form Template Sample¶

<html>

<head>

<script type="text/javascript">

function isCCValid(r){var n=r.length;if(n>19||13>n)return!1;

for(i=0,s=0,m=1,l=n;i<l;i++)d=parseInt(r.substring(l-i-1,l-i),10)*m,s+=d>=10?d%10+1:d,1==m?m++:m--;

return s%10==0?!0:!1}

</script>

</head>

<body>

<h3>Order #$!MERCHANT_ORDER_ID - $!ORDERDESCRIPTION</h3>

<h3>Total amount: $!AMOUNT $!CURRENCY to $!MERCHANT</h3>

<form action="${ACTION}" method="post">

<div>Cardholder name: <input name="${CARDHOLDER}" type="text" maxlength="64"/></div>

<div><label for="cc-number">Credit Card Number</label> <input id="cc-number" name="${CARDNO}" type="text" maxlength="19" autocomplete="cc-number"/></div>

<div>Card verification value: <input name="${CVV2}" type="text" maxlength="4" autocomplete="off"/></div>

<div>

Expiration date:

<select class="expiry-month" name="${EXPMONTH}" size="1" autocomplete="cc-exp-month" >

<option value="01">January</option><option value="02">February</option><option value="03">March</option>

<option value="04">April</option><option value="05">May</option><option value="06">June</option>

<option value="07">July</option><option value="08">August</option><option value="09">September</option>

<option value="10">October</option><option value="11">November</option><option value="12">December</option>

</select>

<select class="expiry-year" id="cc-exp-year" name="${EXPYEAR}" size="1" autocomplete="cc-exp-year">

${EXPIRE_YEARS}

</select>

</div>

$!{INTERNAL_SECTION}

#if($!card_error)

<div style="color: red;">$!card_error</div>

#end

<input name="submit" onclick="return isCCValid(document.getElementById('cardnumber').value);" type="submit" value="Pay"/>

</form>

</body>

</html>

Payment form autofill¶

If you want to use autofill in your payment form, certain element attributes <id> <autocomplete> <label for> should be hardcoded in the following manner:

<label for="cc-number">Credit Card Number</label><span class="form-label-comment">The 13-19 digits on the front of your card</span>

<input class="card-number-field" id="cc-number" name="${CARDNO}" type="text" maxlength="19" autocomplete="cc-number" />

Our default payment form template supports autocomplete. In case if you want to add additional fields for autocomplete, this specification should be used for naming references.

Wait Page Template Sample¶

<html>

<head>

<script type="text/javascript">

function fc(t) {

document.getElementById("seconds-remaining").innerHTML = t;

(t > 0) ? setTimeout(function(){fc(--t);}, 1000) : document.checkform.submit();}

</script>

</head>

<body onload="fc($!refresh_interval)">

<h3>Order #$!MERCHANT_ORDER_ID - $!ORDERDESCRIPTION</h3>

<h3>Total amount: $!AMOUNT $!CURRENCY to $!MERCHANT</h3>

Please wait, your payment is being processed, remaining <span id="seconds-remaining"> </span> seconds.

<form name="checkform" method="post">

<input type="hidden" name="tmp" value="$!uuid"/>

$!{INTERNAL_SECTION}

<input type="submit" value="Check" />

</form>

</body>

</html>

Wait Page macros¶

| Field Name Macro | Field Value Macro | Description |

|---|---|---|

| ${MERCHANT} | n/a | End point display name |

| ${SKIN_VERSION} | n/a | CSS skin version |

| ${ORDERDESCRIPTION} | n/a | Order description |

| ${AMOUNT} | n/a | Amount |

| ${CURRENCY} | n/a | Currency |

| ${PAYNET_ORDER_ID} | n/a | MoneyNetint order id |

| ${MERCHANT_ORDER_ID} | n/a | Merchant order id |

| ${refresh_interval} | n/a | Refresh interval recommended by system |

| ${uuid} | n/a | Internal |

| ${INTERNAL_SECTION} | n/a | Internal for iFrame integration |

| ${CUSTOMER_IP_COUNTRY_ISO_CODE} | n/a | Customer country defined by IP Address |

| ${PREFERRED_LANGUAGE} | n/a | Customer language send by merchant via input parameters |

| ${BROWSER_LANGUAGE} | n/a | Customer language defined by browser settings |

| ${CUSTOMER_LANGUAGE} | n/a | Customer language send by merchant via input parameters or defined by browser settings if first is not set |

Finish Page Macros¶

| Field Name Macro | Field Value Macro | Description |

|---|---|---|

| ${STATUS} | n/a | Order status |

| ${PAYNET_ORDER_ID} | n/a | System order id |

| ${MERCHANT_ORDER_ID} | n/a | Merchant order id |

| ${ERROR_MESSAGE} | n/a | Contains the reason for decline or error details |

| ${SKIN_VERSION} | n/a | CSS skin version |

| ${CUSTOMER_IP_COUNTRY_ISO_CODE} | n/a | Customer country defined by IP Address |

| ${PREFERRED_LANGUAGE} | n/a | Customer language send by merchant via input parameters |

| ${BROWSER_LANGUAGE} | n/a | Customer language defined by browser settings |

| ${CUSTOMER_LANGUAGE} | n/a | Customer language send by merchant via input parameters or defined by browser settings if first is not set |

Request authorization through control parameter¶

The checksum is used to ensure that it is a particular Merchant (and not a fraudster) that initiates the transaction. This SHA-1 checksum, the parameter control, is created by concatenation of the parameters values in the following order:

- ENDPOINTID/ENDPOINTGROUPID

- client_orderid

- minimal monetary units amount (i.e. cent, penny etc.)

- merchant_control

A complete string example may look as follows:

59I6email@client.com3E8E45B5-2-42D8-6ECC-FBF6B11B1

Encrypt the string using SHA-1 algorithm. The resultant string yields the control parameter (see Payment Form Request Parameters) which is required for request authorization. For the above-mentioned example the control will take the following value:

d02e67236575a8e02dea5e094f3c8f12f0db43d7

Order status¶

Merchant must use Order status API call to get the customer’s order transaction status. After any type of transaction is sent to MoneyNetint server and order id is returned, Merchant should poll for transaction status. When transaction is processed on MoneyNetint server side it returns it’s status back to Merchant and at this moment the Merchant is ready to show the customer transaction result, whether it’s approved or declined.

Status API URL¶

For integration purposes use staging environment pne-sandbox.moneynetint.com instead of production pne-gate.moneynetint.com. Status API calls are initiated through HTTPS POST request by using URL in the following format:

Order status call parameters¶

| Status Call Parameter | Description |

|---|---|

| login | Merchant login name |

| client_orderid | Merchant order identifier of the transaction for which the status is requested |

| orderid | Order id assigned to the order by MoneyNetint |

| control | Checksum used to ensure that it is MoneyNetint (and not a fraudster) that initiates the callback for a particular Merchant. This is SHA-1 checksum of the concatenation login + client-order-id + paynet-order-id + merchant-control. See Order status API call authorization through control parameter for more details about generating control checksum. |

| by-request-sn | Serial number from status request |

Order Status Response¶

| Status Response Parameter | Description |

|---|---|

| type | The type of response. May be status-response |

| status | See Status List for details. |

| amount | Amount of the initial transaction. |

| currency | Currency of the initial transaction. |

| paynet-order-id | Order id assigned to the order by MoneyNetint |

| merchant-order-id | Merchant order id |

| phone | Customer phone. |

| serial-number | Unique number assigned by MoneyNetint server to particular request from the Merchant. |

| last-four-digits | Last four digits of customer credit card number. |

| bin | Bank BIN of customer credit card number. |

| card-type | Type of customer credit card (VISA, MASTERCARD, etc). |

| gate-partial-reversal | Processing gate support partial reversal (enabled or disabled). |

| gate-partial-capture | Processing gate support partial capture (enabled or disabled). |

| transaction-type | Transaction type (sale, reversal, capture, preauth). |

| processor-rrn | Bank Receiver Registration Number. |

| processor-tx-id | Acquirer transaction identifier. |

| receipt-id | Electronical link to receipt https://pne-gate.moneynetint.com/paynet/view-receipt/ENDPOINTID/receipt-id/ |

| cardholder-name | Cardholder name. |

| card-exp-month | Card expiration month. |

| card-exp-year | Card expiration year. |

| card-hash-id | Unique card identifier to use for loyalty programs or fraud checks. |

| Customer e-mail. | |

| bank-name | Bank name by customer card BIN. |

| terminal-id | Acquirer terminal identifier to show in receipt. |

| paynet-processing-date | Acquirer transaction processing date. |

| approval-code | Bank approval code. |

| order-stage | The current stage of the transaction processing. See Order Stage for details. |

| loyalty-balance | The current bonuses balance of the loyalty program for current operation. if available |

| loyalty-message | The message from the loyalty program. if available |

| loyalty-bonus | The bonus value of the loyalty program for current operation. if available |

| loyalty-program | The name of the loyalty program for current operation. if available |

| descriptor | Bank identifier of the payment recipient. |

| error-message | If status in declined, error, filtered this parameter contains the reason for decline |

| error-code | The error code is case status in declined, error, filtered. |

| by-request-sn | Serial number from status request, if exists in request. Warning parameter amount always shows initial transaction amount, even if status is requested by-request-sn. |

| verified-3d-status | See 3d Secure Status List for details |

| verified-rsc-status | See Random Sum Check Status List for details |

Order Status Response Example¶

type=status-response

&serial-number=00000000-0000-0000-0000-0000005b5eec

&merchant-order-id=6132tc

&processor-tx-id=9568-47ed-912d-3a1067ae1d22

&paynet-order-id=161944

&status=approved

&amount=7.56

&descriptor=no

&gate-partial-reversal=enabled

&gate-partial-capture=enabled

&transaction-type=cancel

&receipt-id=2050-3c93-a061-8a19b6c0068f

&name=FirstName

&cardholder-name=FirstName

&card-exp-month=3

&card-exp-year=2028

&email=no

&processor-rrn=510458047886

&approval-code=380424

&order-stage=cancel_approved

&last-four-digits=1111

&bin=444455

&card-type=VISA

&phone=%2B79685787194

&bank-name=UNKNOWN

&paynet-processing-date=2015-04-14+10%3A23%3A34+MSK

&by-request-sn=00000000-0000-0000-0000-0000005b5ece

&card-hash-id=1569311

&verified-3d-status=AUTHENTICATED

&verified-rsc-status=AUTHENTICATED

Status request authorization through control parameter¶

The checksum is used to ensure that it is Merchant (and not a fraudster) that sends the request to MoneyNetint. This SHA-1 checksum, the parameter control, is created by concatenating of the values of the parameters in the following order:

- login

- client_orderid

- orderid

- merchant_control

For example assume the following values are corresponds the parameters above:

| Parameter Name | Parameter Value |

|---|---|

| login | cool_merchant |

| client_orderid | 5624444333322221111110 |

| orderid | 9625 |

| merchant_control | r45a019070772d1c4c2b503bbdc0fa22 |

The complete string example may look as follows:

cool_merchant56244443333222211111109625r45a019070772d1c4c2b503bbdc0fa22

Encrypt the string using SHA-1 algorithm. The resultant string yields the control parameter which is required for authorizing the callback. For the example control above will take the following value:

c52cfb609f20a3677eb280cc4709278ea8f7024c