3.4. Parallel form integration¶

3.4.1. General parallel form payment process flow¶

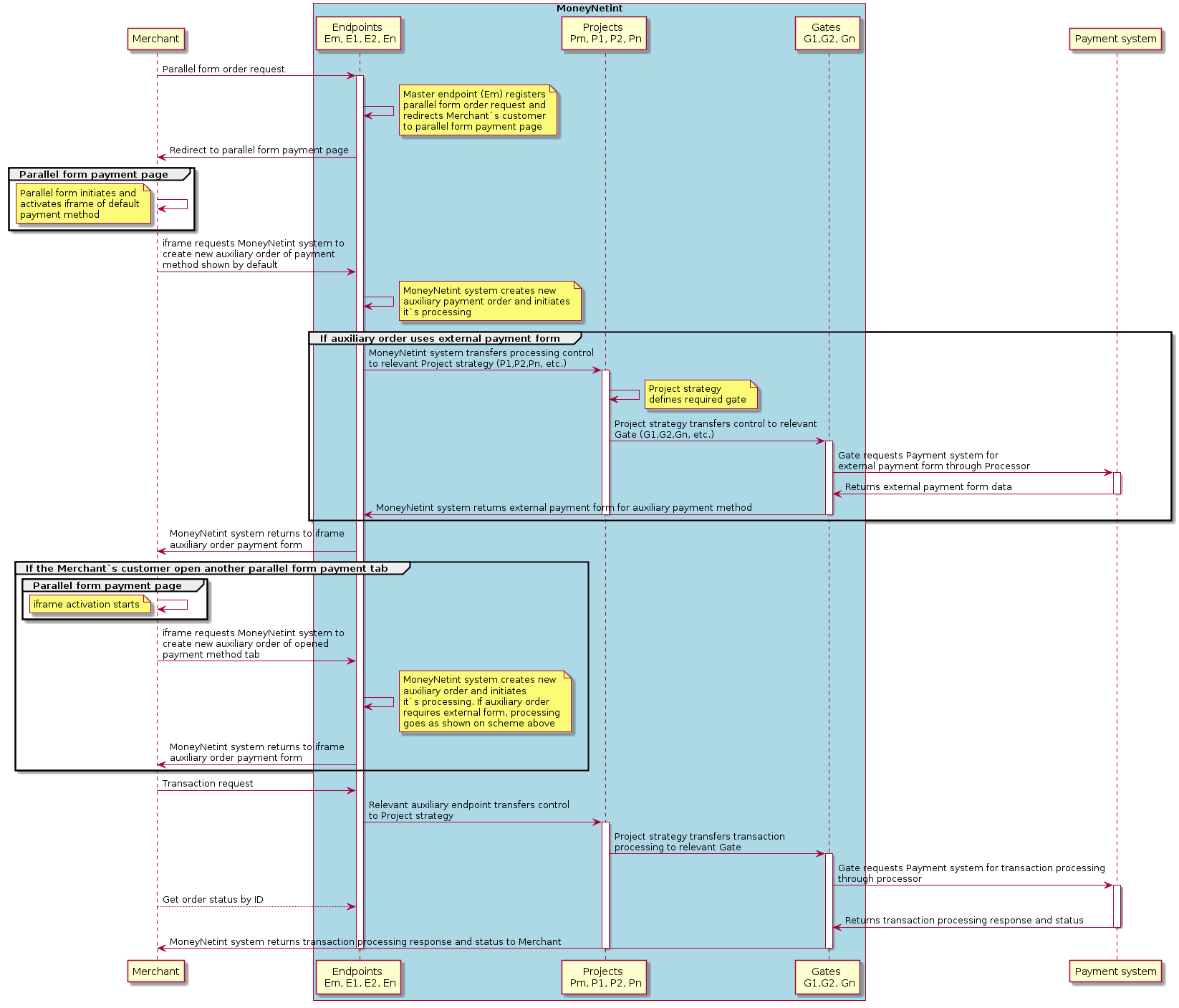

Merchant initiates a transaction by sending HTTPS POST request to the specified URL of the Master endpoint. After that, the Master endpoint registers this request as a parallel form payment order, returns the response back to Merchant and redirects Merchant`s customer to parallel form payment page. Then, the parallel form activation process starts. Initially, parallel form initiates and activates iframe of payment method selected by default. Iframe method requests MoneyNetint system to create new auxiliary order for payment method selected by default. MoneyNetint system creates new auxiliary order and starts to process it. First of all, MoneyNetint system returns to Merchant payment form for this order. If the auxiliary order requires external payment form, MoneyNetint system transfers processing to relevant Gate, which requests Payment system for external payment form. After that, MoneyNetint system returns external form for auxiliary payment order to iframe on parallel form and Merchant`s Customer sees parallel form with default payment method form. If the Customer doesn`t prefer payment method selected by default, he may click on another parallel form tab with the name of payment method. When the Customer clicks on new parallel form tab, he initiates new iframe activation and auxiliary order creation. So, Iframe requests MoneyNetint system to create new auxiliary order for opened payment method tab. Then, MoneyNetint system creates new auxiliary order and starts processing it as was written above. Based on the foregoing, orders scheme in the MoneyNetint system looks the following way:

![@startuml

package "Parallel form order" {

[Auxiliary order 1\nPayment system 1]

[Auxiliary order 2\nPayment system 2]

[Auxiliary order 3\nPayment system 3]

}

@enduml](../_images/plantuml-9295c9ed10ed67234d89a697589d641e05500e0a.png)

After that, the Merchant`s customer fills one of the provided auxiliary order`s payment forms, submits it and initiates HTTPS POST request to perform a transaction. MoneyNetint system registers this transaction request and transfers it to relevant Gate to continue transaction processing. Gate requests Payment system to process transaction through processor. Then, Payment system returns transaction processing response to MoneyNetint system.

3.4.2. Parallel form integration flow¶

Parallel form project schemes¶

Parallel form integration process depends on number of required payment methods and currencies. Initially, Manager should determine all payment methods and currencies which will be available on parallel form payment page. After that, the Manager can start the Project creation and configuration. System scheme may be organized and customized in different ways. For example, if the Merchant requires payment operations only in one currency, system scheme may look the following way:

![@startuml

package "Master Endpoint" {

[Card payment endpoint]

[Neteller endpoint]

[n - payment system endpoint]

}

package "Project USD" {

[Strategy]

}

[Card payment endpoint] --> [Strategy]

[Neteller endpoint] --> [Strategy]

[n - payment system endpoint] --> [Strategy]

node "Neteller Gate USD" {

[Neteller processor]

}

node "Card payment Gate USD" {

[Card payment processor]

}

node "n Gate USD" {

[n-processor]

}

[Strategy] --> [Neteller processor]

[Strategy] --> [Card payment processor]

[Strategy] --> [n-processor]

@enduml](../_images/plantuml-14d2f0396de349ec243f5b701a6a283bc157900b.png)

If the Merchant requires payment operations in different currencies, the system scheme example may look as follows:

![@startuml

package "Master Endpoint" {

[Card payment endpoint]

[AstroPay endpoint]

[Neteller endpoint]

[n - payment system endpoint]

}

package "Project USD" {

[Card Payment & AstroPay\nStrategy USD]

}

package "Project EUR" {

[Neteller\nStrategy EUR]

}

package "Project JPY" {

[n - payment system\nStrategy JPY]

}

node "Neteller Gate EUR" {

[Neteller processor]

}

node "Card payment Gate USD" {

[Card payment processor]

}

node "AstroPay Gate USD" {

[AstroPay processor]

}

node "n Gate JPY" {

[n-processor]

}

[Card payment endpoint] --> [Card Payment & AstroPay\nStrategy USD]

[AstroPay endpoint] --> [Card Payment & AstroPay\nStrategy USD]

[Neteller endpoint] --> [Neteller\nStrategy EUR]

[n - payment system endpoint] --> [n - payment system\nStrategy JPY]

[Card Payment & AstroPay\nStrategy USD] --> [Card payment processor]

[Card Payment & AstroPay\nStrategy USD] --> [AstroPay processor]

[Neteller\nStrategy EUR] --> [Neteller processor]

[n - payment system\nStrategy JPY] --> [n-processor]

@enduml](../_images/plantuml-50e7bef102a053f8977831815a98f03f524f4112.png)

Master endpoint is mandatory element for both system schemes. It has auxiliary endpoints with different currencies for all required payment methods. If we have two payment methods with usage of one currency, as you may see on example above (AstroPay and Card Payment), we may combine them to one project (Project USD). Otherwise, we may create particular project for each payment method. All of these two variants will be correct.

Parallel form Master endpoint settings¶

In order to use parallel form correctly, the specialist should set the project settings in a proper way. You may find an instruction concerning special project settings below.

- Initially, Merchant should create a project. If he wants to integrate parallel form which includes payment methods nominated in different currencies, he should create at least one project for each currency. For example, if the Merchant wants to proceed payments in USD, EUR and JPY, he should create 3 different projects.

- After the projects were created, Merchant should create all required endpoints for provided payment methods and bind them to appropriate projects. All these endpoints will be auxiliary to Master endpoint which will be created on the next step.

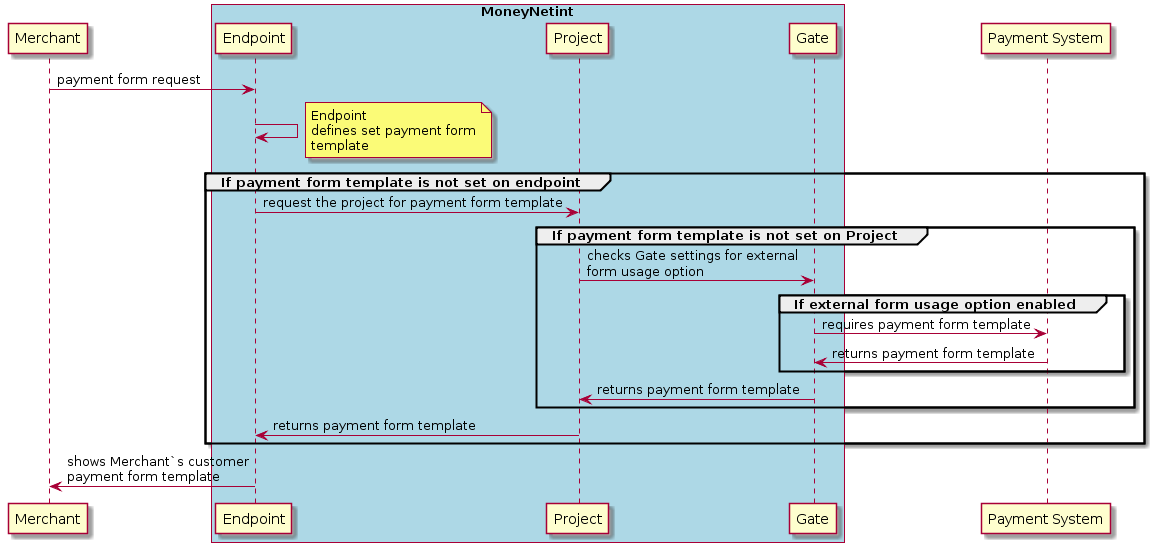

- To create Master endpoint, Merchant should press (Settings -> Configuration -> Master endpoints -> +Master Endpoint). In the settings of Master endpoint Merchant should set Parallel form payment template(Master endpoint properties -> Common -> Edit -> Payment form template). Thus, when the Merchant sends request to Master endpoint, MoneyNetint system returns to him parallel form payment template which is defined on the Master endpoint level. As well, the parallel form payment template or any other form template can be set on the Project settings level(Project properties -> Common -> Edit -> Payment form template). So, when the Merchant will send the sale request to Master endpoint without parallel form template, Master endpoint inherit parallel form template from the project settings. Such form template returning algorithm is used for all kinds of form templates: payment, waiting and finish templates. You may see the full algorithm on the scheme below (payment form example):

- After that, the Merchant should set all the auxiliary endpoints in the Master endpoint settings(Master endpoint properties -> Auxiliary endpoints -> Edit). To add new auxiliary endpoint, Merchant should press “Add” button. After that he should fill a form with 3 fields: “Endpoint”, “Payment method” and “Payment method reference name”. In the “Endpoint” field Merchant should choose one of the available endpoints which were created before. The “Payment method” field defines the name of payment method which will be shown on the relevant parallel form tab. “Payment method reference name” field defines the internal reference name of this payment method. After the auxiliary endpoint was added, Merchant also may set the countries where the payment method of this auxiliary endpoint is available. To do that, the Merchant should press the button with three points which stays opposite of the auxiliary endpoint field.

- Then, the Merchant should set all another required parameters of system elements.

3.4.3. Parallel form payment request¶

For integration purposes use staging environment pne-sandbox.moneynetint.com instead of production pne-gate.moneynetint.com. Parallel form payment requests are initiated through HTTPS POST request by using URL in the following format:

Parallel form payment request parameters¶

In order to initiate a payment transaction through the parallel form, Merchant sends an HTTPS POST request with the following parameters:

| Request parameter name | Length/Type | Comment | Necessity* |

|---|---|---|---|

| client_orderid | 128/String | Merchant order identifier. | Mandatory |

| order_desc | 64k/String | Brief order description. | Mandatory |

| first_name | 50/String | Customer’s first name. | Mandatory |

| last_name | 50/String | Customer’s last name. | Mandatory |

| ssn | 32/Numeric | Last four digits of the customer’s social security number. | Optional |

| birthday | 8/Numeric | Customer’s date of birth, in the format YYYYMMDD. | Optional |

| address1 | 50/String | Customer’s address line 1. | Mandatory |

| city | 50/String | Customer’s city. | Mandatory |

| state | 2/String | Customer’s state (two-letter state code). Please see Reference for a list of valid state codes. Mandatory for USA, Canada and Australia. | Conditional |

| zip_code | 10/String | Customer’s ZIP code. | Mandatory |

| country | 2/String | Customer’s country(two-letter country code). Please see Reference for a list of valid country codes. | Mandatory |

| phone | 15/String | Customer’s full international phone number, including country code. | Mandatory |

| cell_phone | 15/String | Customer’s full international cell phone number, including country code. | Optional |

| 50/String | Customer’s email address. | Mandatory | |

| amount | 10/Numeric | Amount to be charged. The amount has to be specified in the highest units with . delimiter. 10.5 for USD means 10 US Dollars and 50 Cents. | Mandatory |

| currency | 3/String | Currency the transaction is charged in (three-letter currency code). Sample values are: USD for US Dollar EUR for European Euro. | Mandatory |

| ipaddress | 20/String | Customer’s IP address, included for fraud screening purposes. | Mandatory |

| site_url | 128/String | URL the original sale is made from. | Optional |

| control | 40/String | Checksum generated by SHA-1. See Request authorization through control parameter for more details. | Mandatory |

| redirect_url | 128/String | URL the cardholder will be redirected to upon completion of the transaction. Please note that the cardholder will be redirected in any case, no matter whether the transaction is approved or declined. You should not use this parameter to retrieve results from MoneyNetint gateway, because all parameters go through client’s browser and can be lost during transmission. To deliver the correct payment result to your backend use server_callback_url instead. | Mandatory |

| server_callback_url | 1024/String | URL the transaction result will be sent to. Merchant may use this URL for custom processing of the transaction completion, e.g. to collect sales data in Merchant’s database. See more details at Merchant Callbacks. | Optional |

Parallel form payment request example¶

client_orderid=902B4FF5

&order_desc=Test Order Description

&first_name=John

&last_name=Smith

&birthday=19820115

&address1=100 Main st

&city=Seattle

&state=WA

&zip_code=98102

&country=US

&phone=+12063582043

&cell_phone=+19023384543

&amount=10

&email=john.smith@gmail.com

¤cy=USD

&ipaddress=65.153.12.232

&site_url=www.google.com

&purpose=www.twitch.tv/dreadztv

&redirect_url=http://pne-doc.moneynetint.com/doc/dummy.htm

&server_callback_url=http://pne-doc.moneynetint.com/doc/dummy.htm

&merchant_data=VIP customer

&control=5fdc17c7fd70e01d55396de4de34ab95434578df

3.4.4. Parallel form response¶

Parallel form response parameters¶

| Response parameters | Description |

|---|---|

| type | The type of response. May be async-response, validation-error, error. If type equals validation-error or error, error-message and error-code parameters contain error details. |

| serial-number | Unique number assigned by MoneyNetint server to particular request from the Merchant. |

| merchant-order-id | Merchant order id. |

| paynet-order-id | Order id assigned to the order by MoneyNetint. |

| redirect-url | URL of the parallel form the customer will be redirected to. |

| error-message | If status is error this parameter contains the reason for decline or error details. |

| error-code | The error code is case of error status. |

Parallel form response example¶

type=async-form-response

&serial-number=00000000-0000-0000-0000-000001c46d4b

&merchant-order-id=007

&paynet-order-id=2625009

&redirect-url=https://pne-gate.moneynetint.com/paynet/form/init/BB624D58465A2F6A67677534686B414D53396234794C625A7047627A38534B31532F473455445865457469493D

3.4.5. Parallel form status request¶

Merchant must use Order status API call to get the customer’s parallel form order or auxiliary order status. After any type of transaction is sent to MoneyNetint server and order id is returned, Merchant should poll for transaction status. When transaction is processed on MoneyNetint server side it returns it’s status back to Merchant and at this moment the Merchant is ready to show the customer transaction result, whether it’s approved or declined.

Status API URL¶

For integration purposes use staging environment pne-sandbox.moneynetint.com instead of production pne-gate.moneynetint.com. Status API calls are initiated through HTTPS POST request by using URL in the following format:

Order status call parameters¶

| Status Call Parameter | Description |

|---|---|

| login | Merchant login name. |

| client_orderid | Merchant order identifier of the transaction for which the status is requested. |

| orderid | Order id assigned to the order by MoneyNetint. |

| control | Checksum used to ensure that it is MoneyNetint (and not a fraudster) that initiates the callback for a particular Merchant. This is SHA-1 checksum of the concatenation login + client-order-id + paynet-order-id + merchant-control. See Order status API call authorization through control parameter for more details about generating control checksum. |

| by-request-sn | Serial number from status request. |

Order Status Response¶

| Status Response Parameter | Description |

|---|---|

| type | The type of response. May be status-response. |

| status | See Status List for details. |

| amount | Amount of the initial transaction. |

| currency | Currency of the initial transaction. |

| paynet-order-id | Order id assigned to the order by MoneyNetint. |

| merchant-order-id | Merchant order id. |

| phone | Customer phone. |

| html | HTML code of 3D authorization form, encoded in application/x-www-form-urlencoded MIME format. Merchant must decode this parameter before showing the form to the Customer. The MoneyNetint System returns the following response parameters when it gets 3D authorization form from the Issuer Bank. It contains auth form HTML code which must be passed through without any changes to the client’s browser. This parameter exists and has value only when the redirection HTML is already available. For non-3D this never happens. For 3D HTML has value after some short time after the processing has been started. |

| serial-number | Unique number assigned by MoneyNetint server to particular request from the Merchant. |

| last-four-digits | Last four digits of customer credit card number. |

| bin | Bank BIN of customer credit card number. |

| card-type | Type of customer credit card (VISA, MASTERCARD, etc). |

| gate-partial-reversal | Processing gate support partial reversal (enabled or disabled). |

| gate-partial-capture | Processing gate support partial capture (enabled or disabled). |

| transaction-type | Transaction type (sale, reversal, capture, preauth). |

| processor-rrn | Bank Receiver Registration Number. |

| processor-tx-id | Acquirer transaction identifier. |

| receipt-id | Electronical link to receipt https://pne-gate.moneynetint.com/paynet/view-receipt/ENDPOINTID/receipt-id/. |

| cardholder-name | Cardholder name. |

| card-exp-month | Card expiration month. |

| card-exp-year | Card expiration year. |

| card-hash-id | Unique card identifier to use for loyalty programs or fraud checks. |

| Customer e-mail. | |

| bank-name | Bank name by customer card BIN. |

| terminal-id | Acquirer terminal identifier to show in receipt. |

| paynet-processing-date | Acquirer transaction processing date. |

| approval-code | Bank approval code. |

| order-stage | The current stage of the transaction processing. See Order Stage for details. |

| loyalty-balance | The current bonuses balance of the loyalty program for current operation. if available |

| loyalty-message | The message from the loyalty program. if available |

| loyalty-bonus | The bonus value of the loyalty program for current operation. if available |

| loyalty-program | The name of the loyalty program for current operation. if available |

| descriptor | Bank identifier of the payment recipient. |

| error-message | If status in declined, error, filtered this parameter contains the reason for decline. |

| error-code | The error code is case status in declined, error, filtered. |

| by-request-sn | Serial number from status request, if exists in request. Warning parameter amount always shows initial transaction amount, even if status is requested by-request-sn. |

| verified-3d-status | See 3d Secure Status List for details. |

| verified-rsc-status | See Random Sum Check Status List for details. |

Order Status Response Example¶

type=status-response

&serial-number=00000000-0000-0000-0000-000001c473e3

&merchant-order-id=902B4FF5

&paynet-order-id=2625444

&status=processing

&amount=10.42

¤cy=USD

&transaction-type=sale

&receipt-id=a0ad593e-9f45-38dc-b334-54a853faf634

&name=Unknown+holder

&cardholder-name=Unknown+holder

&card-exp-month=12

&card-exp-year=2018

&email=john.smith%40gmail.com

&order-stage=sale_starting

&merchantdata=VIP+customer

&last-four-digits=9999

&bin=999999

&card-type=PARALLEL_FORM

&phone=12063582043

&paynet-processing-date=2017-05-26+16%3A22%3A55+MSK

&by-request-sn=00000000-0000-0000-0000-000001c473d9

&card-hash-id=1226718

&purpose=www.twitch.tv%2Fdreadztv

Status request authorization through control parameter¶

The checksum is used to ensure that it is Merchant (and not a fraudster) that sends the request to MoneyNetint. This SHA-1 checksum, the parameter control, is created by concatenation of the parameters values in the following order:

- login

- client_orderid

- orderid

- merchant_control

For example, assume these parameters have the values as listed below:

| Parameter Name | Parameter Value |

|---|---|

| login | PARL_TEST_Merchant |

| client_orderid | 902B4FF5 |

| orderid | 2625444 |

| merchant_control | 2DB0DF52-7379-4276-AABF-4E774DEDDCF9 |

The complete string example may look as follows:

PARL_TEST_Merchant902B4FF526254442DB0DF52-7379-4276-AABF-4E774DEDDCF9

Encrypt the string using SHA-1 algorithm. The resultant string yields the control parameter which is required for authorizing the callback. For the example control above will take the following value:

fbddc45a8cdb0f59199ac9e0c11ea3d6113964d1

3.4.6. Parallel form templates¶

Parallel form template sample¶

<html>

<head>

<meta http-equiv="Content-Type" content="text/html; charset=utf-8"/>

</head>

<body>

<!-- country selector -->

<span id="countryIsoCode" style="display: none;">$!CUSTOMER_IP_COUNTRY_ISO_CODE</span>

<div class="container">

<input name="customer_language_code" id="iso" type="hidden" value="$CUSTOMER_LANGUAGE"/>

#if (!$HAS_PARALLEL_FORM_PAYMENT_METHODS)

<select id="countrySelector" onchange="onCountrySelected(this);">

<option value="EU">Europe</option>

<!-- You may add other countries for selection to this list -->

</select>

#end

#if ($HAS_PARALLEL_FORM_PAYMENT_METHODS)

<div class="form-tabs">

<ul id="formTabs" class="form-tabs-ul">

#foreach ($paymentMethod in $PARALLEL_FORM_PAYMENT_METHODS)

<li id="$!{paymentMethod.identifier}-FORM-button" class="form-tab-button#if

($velocityCount == 1) form-tab-button-active form-tab-button-active-$!{paymentMethod.identifier}

#end"#if($paymentMethod.iframe) onclick="chooseIframe('$!{paymentMethod.identifier}');"#end>

$!{paymentMethod.name}

</li>

#end

</ul>

<select id="countrySelector" onchange="onCountrySelected(this);">

<option value="EU">Europe</option>

<!-- You may add other countries for selection to this list -->

</select>

</div>

#foreach ($paymentMethod in $PARALLEL_FORM_PAYMENT_METHODS)

<div class="ssl-header ssl-header-$!{paymentMethod.identifier}" id="merchant-description-$!{paymentMethod.identifier}"

#if ($velocityCount > 1) style="display: none;"#end>

<span class="ssl-text">${MERCHANT}</span>

<div>

<span class="flag-EN" id="flag-$!{paymentMethod.identifier}"></span>

<select id="langSelector-$!{paymentMethod.identifier}" class="langSelector langSelector-$!{paymentMethod.identifier}"

onchange="selectLang('$!{paymentMethod.identifier}');">

<option value="EN">English</option>

<!-- You may add other languages for selection to this list -->

</select>

</div>

</div>

<script>

merchantDescriptionIds.push("merchant-description-$!{paymentMethod.identifier}");

paymentMethodsCountries["$!{paymentMethod.identifier}"] = "$!{paymentMethod.countries}";

</script>

#end

#end

#if ($HAS_PARALLEL_FORM_PAYMENT_METHODS)

#foreach ($paymentMethod in $PARALLEL_FORM_PAYMENT_METHODS)

#if ($paymentMethod.iframe)

<div class="frame-container-$!{paymentMethod.identifier} payment-method-iframe"

id="$!{paymentMethod.identifier}-FORM" pneopen="#if ($velocityCount == 1)true#{else}

false#end" pnesrc="$!paymentMethod.initSessionUrl" #if ($velocityCount > 1) style="display: none;"#end>

<iframe src="#if ($velocityCount == 1)$!paymentMethod.initSessionUrl#end" scrolling="#if

($!{paymentMethod.identifier} == 'QIWI' || $!{paymentMethod.identifier} == 'ASTROPAY')yes#{else}no#end">

</iframe>

</div>

#end

#end

<form id="waitForm" action="$!WAIT_FORM_URL">

#foreach( $p in $WAIT_FORM_PARAMETERS )

<input type="hidden" name="$p.key" value="$!p.value">

#end

<!--$!{INTERNAL_SECTION}-->

</form>

#end

</div>

</body>

</html>

The full lists of country and language codes are located in Reference.

Parallel form template macros¶

| Field Name Macro | Field Value Macro | Description |

|---|---|---|

| $!CUSTOMER_IP_COUNTRY_ISO_CODE | n/a | Customer country defined by IP Address. |

| $!CUSTOMER_COUNTRY_CODE | n/a | Billing country of customer sent in incoming API request. |

| $CUSTOMER_LANGUAGE | n/a | Customer language send by merchant via input parameters or defined by browser settings if first is not set. |

| !$HAS_PARALLEL_FORM_PAYMENT_METHODS | n/a | Determines the availability of parallel form payment methods. |

| $paymentMethod | n/a | Payment method object. |

| $PARALLEL_FORM_PAYMENT_METHODS | n/a | Array with available parallel form payment methods. |

| $!{paymentMethod.identifier} | n/a | Payment method identifier. |

| $velocityCount | n/a | Sequence number of the payment method. |

| $paymentMethod.iframe | n/a | Iframe of payment method. |

| $!{paymentMethod.name} | n/a | Payment method name. |

| ${MERCHANT} | n/a | End point display name. |

| $!{paymentMethod.countries} | n/a | Countries which are set for this payment method. |

| $!paymentMethod.initSessionUrl | n/a | URL for payment method session initialization. |

| $!WAIT_FORM_URL | n/a | Waiting form URL. |

| $p | n/a | Waiting form parameter. |

| $WAIT_FORM_PARAMETERS | n/a | Waiting form parameters array. |

| $p.key | n/a | Waiting form parameter key. |

| $!p.value | n/a | Waiting form parameter value. |

| $!{INTERNAL_SECTION} | n/a | Internal for iFrame integration. |

Warning

If needed to determine the customer billing country on the data sent via the API, $! CUSTOMER_COUNTRY_CODE is used. If needed to determine the customer billing country on the IP address from the customer browser, use $! CUSTOMER_IP_COUNTRY_ISO_CODE, billing country will also change according to IP.

Parallel form scripts¶

Here you may find two parallel form scripts which are mandatory needed for it`s operating. The first script should be added into <head> tag of html document:

<script type="text/javascript">

var merchantDescriptionIds = [];

var paymentMethodsCountries = {};

function isCCValid(r) {

var n = r.length;

if (n > 19 || 13 > n) return !1;

for (i = 0, s = 0, m = 1, l = n; i < l; i++) d = parseInt(r.substring(l - i - 1, l - i), 10) * m, s += d >= 10 ? d % 10 + 1 : d, 1 == m ? m++ : m--;

return s % 10 == 0 ? !0 : !1

}

function runPayment(t) {

if (isCCValid(t)) {

return !0;

} else {

document.getElementById('cardnumber').style.borderColor = '#fb860f';

return !1;

}

}

function chooseIframe(paymentMethodName) {

var id = paymentMethodName + '-FORM';

var iframes = document.getElementsByTagName('IFRAME');

for (var i = 0; i < iframes.length; i++) {

var iframe = iframes[i].parentNode;

var isCurrent = iframe.id == id;

iframe.style.display = isCurrent ? 'block' : 'none';

if (isCurrent && iframe.getAttribute("pneopen") == 'false') {

iframe.firstElementChild.src = iframe.getAttribute("pnesrc") + "?country=" + document.getElementById("countryIsoCode").innerText;

iframe.setAttribute("pneopen", 'true');

}

var buttonElem = document.getElementById(iframe.id + '-button');

buttonElem.className = (iframe.id == id) ? 'form-tab-button form-tab-button-active form-tab-button-active-' + paymentMethodName : 'form-tab-button';

}

var descriptionId = 'merchant-description-' + paymentMethodName;

for (var i = 0; i < merchantDescriptionIds.length; i++) {

var isCurrent = merchantDescriptionIds[i] == descriptionId;

document.getElementById(merchantDescriptionIds[i]).style.display = isCurrent ? 'flex' : 'none';

}

}

function pneInit() {

window.pneMasterSessionProcessed = function() {

document.getElementById('waitForm').submit()

}

#foreach( $paymentMethod in $PARALLEL_FORM_PAYMENT_METHODS )

#if( $paymentMethod.default )chooseIframe('$!{paymentMethod.identifier}-FORM');

#break

#end

#end

}

</script>

Second script should be added to html code before the </body> close tag.

<script type="text/javascript">

function updateTabsVisibility() {

var countryCode = getSelectedCountryCode();

var paymentMethods = getPaymentMethods();

var someIframeShown = false;

for (var i = 0; i < paymentMethods.length; i++) {

var paymentMethod = paymentMethods[i];

var visible = isPaymentMethodVisible(paymentMethod, countryCode);

updateTabVisibility(paymentMethod, visible);

if (visible && !someIframeShown) {

chooseIframe(paymentMethod);

someIframeShown = true;

}

}

}

function getSelectedCountryCode() {

return document.getElementById('countryIsoCode').innerText;

}

function setSelectedCountryCode(countryCode) {

document.getElementById('countryIsoCode').innerText = countryCode;

}

function getPaymentMethods() {

var lis = document.getElementById("formTabs").children;

var result = [];

for (var i = 0; i < lis.length; i++) {

var li = lis[i];

var id = li.id;

if (id != null) {

result.push(id.substring(0, id.indexOf("-FORM-button")));

}

}

return result;

}

function isPaymentMethodVisible(paymentMethodId, countryCode) {

if (paymentMethodsCountries[paymentMethodId] == "") {

return true;

} else {

return paymentMethodsCountries[paymentMethodId].indexOf(countryCode) > -1;

}

}

function updateTabVisibility(paymentMethod, visible) {

document.getElementById(paymentMethod + '-FORM-button').style.display = visible ? 'inline-block' : 'none';

}

function onCountrySelected(selector) {

setSelectedCountryCode(selector.value);

updateTabsVisibility();

}

document.addEventListener('DOMContentLoaded', function() {

pneInit();

updateTabsVisibility();

document.getElementById('countrySelector').value = getSelectedCountryCode();

});

function syncLangSelectors(ISO) {

var methods = getPaymentMethods();

for (var i = 0; i < methods.length; i++) {

document.getElementById('flag-' + methods[i]).className = "flag-" + ISO;

document.getElementById('langSelector-' + methods[i]).value = ISO;

}

}

var ISO = document.getElementById('iso').value.toUpperCase();

ISO = 'EN';

document.getElementById('iso').value = ISO;

syncLangSelectors(ISO);

document.addEventListener('DOMContentLoaded', function() {

//l10n();

});

function selectLang(method) {

var ISO = document.getElementById('langSelector-' + method).value.toUpperCase();

document.getElementById('iso').value = ISO;

syncLangSelectors(ISO);

//l10n();

}

</script>

Waiting form template¶

<html>

<head>

<script type="text/javascript">

function fc(t) {

document.getElementById("seconds-remaining").innerHTML = t;

(t > 0) ? setTimeout(function(){fc(--t);}, 1000) : document.checkform.submit();}

</script>

</head>

<body onload="fc($!refresh_interval)">

<h3>Order #$!MERCHANT_ORDER_ID - $!ORDERDESCRIPTION</h3>

<h3>Total amount: $!AMOUNT $!CURRENCY to $!MERCHANT</h3>

Please wait, your payment is being processed, remaining <span id="seconds-remaining"> </span> seconds.

<form name="checkform" method="post">

<input type="hidden" name="tmp" value="$!uuid"/>

$!{INTERNAL_SECTION}

<input type="submit" value="Check" />

</form>

</body>

</html>

Waiting form template macros¶

| Field Name Macro | Field Value Macro | Description |

|---|---|---|

| $!refresh_interval | n/a | Refresh interval recommended by system. |

| $!MERCHANT_ORDER_ID | n/a | Merchant order id. |

| $!ORDERDESCRIPTION | n/a | Order description. |

| $!AMOUNT | n/a | Amount. |

| $!CURRENCY | n/a | Currency. |

| $!MERCHANT | n/a | End point display name. |

| $!uuid | n/a | Internal. |

| $!{INTERNAL_SECTION} | n/a | Internal for iFrame integration. |

Finish form template¶

<html>

<head>

</head>

<body>

<h3>Processing of the payment has finished</h3>

<h3>Order Invoice: $!{MERCHANT_ORDER_ID}</h3>

<h3>Order ID: $!{PAYNET_ORDER_ID}</h3>

<h3>Status: $!{STATUS}</h3>

#if($ERROR_MESSAGE)

<h3>Error: $!{ERROR_MESSAGE}</h3>

#end

</body>

</html>

Finish form template macros¶

| Field Name Macro | Field Value Macro | Description |

|---|---|---|

| $!MERCHANT_ORDER_ID | n/a | Merchant order id. |

| $!{PAYNET_ORDER_ID} | n/a | MoneyNetint order id. |

| $!{STATUS} | n/a | Order status. |

| $!{ERROR_MESSAGE} | n/a | Error message. |