6.3. Chargeback flow and transaction types¶

6.3.1. Chargeback terms¶

| Name | Description |

|---|---|

| Retrieval Request | An Issuer`s request for a Transaction Receipt, which could include the original, a paper copy of facsimile, or an electronic version thereof. |

| Chargdeback | A Transaction that an Issuer returns to an Acquirer. The Issuer can only make chargeback for a valid reason as described in VISA/MC rules. |

| Representment |

The Acquirer can only make representment for a valid reason as described in VISA/MC rules. As this is the 2nd time that Acquirer presented this transaction to the Issuer, it is called representment. |

| Arbitration Chargeback | A Transaction that an Issuer returns to an Acquirer for the 2nd time. The Issuer can only make chatgeback for a valid reason as describet in MC rules. |

| Prearbitration | An attept to resolve the dispute before filing with VISA/MC Arbitration Committee. |

| Arbitration | A process whereby financial liability for Transactions processed through Interchange that are presented and charged back is determined by VISA/MC. |

| CPD (Central Processing Date) | A date when a record (transaction, chargeback, retrieval request etc) has been processed by international payment card schemes. |

| Compiance | A process whereby disputes that arise from violations of any rules govering a Transaction, and no Chargeback right is available, are determined. |

| Good Faith Letter | An attempt to resolve the dispute when no chargeback of compliance rights exist. |

| SAFE/Fraud Advice TC40 | A record prepared by an Issuer to inform VISA/MC of fraudulent merchant activity. |

| TID (Transaction information document) | Term used for transation documentation, such as formsets, records, sales slips, terminal receipts, and record of charges. |

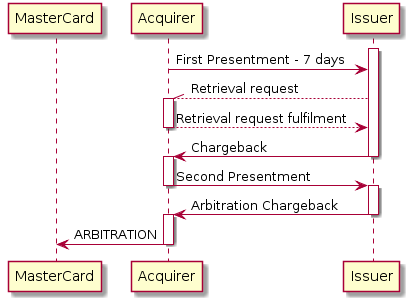

6.3.2. MasterCard Chargeback Guide¶

Chargeback Stages¶

| Stage | Description | MIT-Function Code(s) | API Method | ||

|---|---|---|---|---|---|

| First Presentment | Acquirer submits the transaction to the issuer. | 1240-200 | sale | 45/60/120/540 days | |

| 30 days | Retrieval Request | Issuer may request a copy of the sales ticket to support or identify a potential chargeback. NOTE Most chargebacks do not require a retrieval request |

1644-603 | retrieval | |

| Retrieval request fulfilment | |||||

| 45 days | Chargeback | Issuer initiates a chargeback within the time frame applicable to the specific message reason. (Refer to section 3, MasterCard Message Reason Codes—Dual Message System Transactions for details.) NOTE If an issuer receives a legible copy of the TID through a second presentment for message reason code 4802—Requested/Required Information Illegible or Missing, and after viewing the item for the first time determines that it has another right of chargeback for a different message reason code, the issuer must start the process again with a new chargeback. Refer to section Message Reason Code 4802—Requested/Required Information Illegible or Missing for more information. |

1442-450(full amount) 1442-453(partial amount) |

chargeback | |

| Second Presentment | When applicable, the acquirer may process a second presentment within 45 calendar days of the Central Site Business Date (PDS 0158 [Business Activity], subfield 5 [Business Date]) of the chargeback. | 1240-205(full amount) 1240-282(partial amount) |

chargeback_reversal | 45 days | |

| 45 days | Arbitration Chargeback | When applicable, the issuer may initiate an arbitration chargeback within 45 calendar days of the Central Site Business Date of the second presentment. | 1442-451(full amount) 1442-454(partial amount) |

prearbitration | |

| Arbitration Case Filing | The acquirer may file an arbitration case to MasterCard for a decision on the dispute within 45 calendar days of the Central Site Business Date of the arbitration chargeback. | N/A | arbitration |

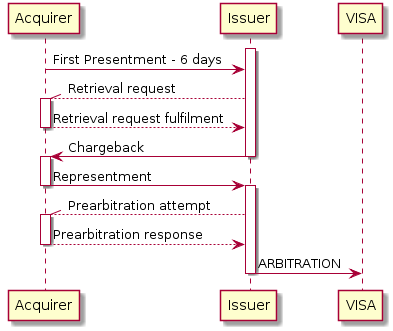

6.3.3. Visa Chargeback Guide¶

Chargeback Stages¶

| Stage | Description | API Method | |||

|---|---|---|---|---|---|

| First Presentment | Acquirer submits the transaction to the issuer. | sale | 75/120/540 days | ||

| 30 days | Retrieval Request | Issuer may request a copy of the sales ticket to support or identify a potential chargeback. | retrieval | ||

| Retrieval Request Fulfil | |||||

| 45 days | Chargeback | Issuer initiates a chargeback within the time frame applicable to the specific message reason. | chargeback | ||

| Representment | When applicable, the acquirer may process a second presentment. | chargeback_reversal | 29 days | 60(30*) days | |

| 30 days | Prearbitration Attempt | Before filing for Arbitration, the requesting Member must make a pre-Arbitration attempt using Visa Resolve Online, at least a full 30 calendar days prior to the Arbitration filing date if any of the following conditions apply:

|

prearbitration | ||

| Prearbitration Response | 30 days | ||||

| Arbitration | If the opposing Member does not accept financial responsibility for the disputed Transaction, the requesting Member may pursue Arbitration. | arbitration | |||

| Arbitration Appeal | The decision on any permitted appeal is final and not subject to any challenge | ||||

* 30 days apply if no prearbitration attempt

6.3.4. Visa Compliance Guide¶

Chargeback Stages¶

| Stage | Description | API Method |

|---|---|---|

| First Presentment | Acquirer submits the transaction to the issuer. | sale |

| Cardholder or issuer disputes the first presentment | ||

| Pre-Compliance | Before filing for Compliance, the requesting Member must attempt to resolve the dispute with the opposing Member. This attempt must include all of the following:

A pre-Compliance attempt must include the information required in the Pre-Compliance Attempt Questionnaire. The pre-Compliance attempt must be sent electronically, using Visa Resolve Online, at least a full 30 calendar days prior to the Compliance filing date. |

|

| Pre-Compliance Acceptance | If the opposing Member accepts financial liability for the disputed Transaction, it must credit the requesting Member for the last amount received by the requesting Member through VisaNet within 30 calendar days of the pre-Compliance attempt date. | |

| Non-Acceptance of Financial Liability for Pre-Compliance | If the opposing Member does not accept financial liability for the disputed Transaction, the requesting Member may pursue Compliance. | |